This leads to higher taxes payable in the year of the debt and lower taxes in the future. Take the 5-year depreciation of a business asset as an example of deferred tax liability. Accounting rules and IRS rules are different when it comes to depreciation.

Your tax liability is the amount you owe to the IRS

Some states have a single tax rate, and others have graduated brackets. A W-4 provides an employer with an employee’s tax ID number (usually SSN), marital status, number of allowances and dependents, and how much tax to withhold with each paycheck. The W-4 is filled out when an employee is hired or if any changes must be made to filing status or withholding. The W-2 is filled out by employers at the end of the tax year and sent to employees to input on their tax returns. The central government net cash requirement (CGNCR) represents the cash needed to be raised from the financial markets over a period to finance its activities.

Estimated Tax Payments 2024: How They Work, Due Dates – NerdWallet

Estimated Tax Payments 2024: How They Work, Due Dates.

Posted: Wed, 16 Jun 2021 23:19:50 GMT [source]

Dave Ramsey Says To Do This If You Owe the IRS With Little Savings

It can be used as a tool for redistributing wealth and promoting social equity. Its ensures that individuals and businesses comply with tax laws and fulfill their legal obligation to contribute to public finances. By accurately calculating and paying taxes owed, taxpayers avoid potential penalties, fines, and legal consequences for non-compliance. Note that if you’re a self-employed solo business owner, you will have to pay a self-employment tax.

- The tax calculator will project your federal refund or tax bill based on income, age, deductions and credits.

- You can estimate your tax liability for the year by adding up all your income and subtracting any applicable deductions, and then applying that figure to the tax tables for your filing status.

- If you require such advice, we recommend consulting a licensed financial or tax advisor.

- If you’re stressed about saving enough money to cover your next tax bill, we have a few ideas that will help.

- This includes several types of taxes, but the most common is taxed on your wages, salaries, investments, self-employment income, and other sources.

- If a passport is required for your travel, you can claim that as well.

Understanding Tax Liability

- A W-4 provides an employer with an employee’s tax ID number (usually SSN), marital status, number of allowances and dependents, and how much tax to withhold with each paycheck.

- Federal tax liability refers to the amount of money you owe the Internal Revenue Service (IRS) in taxes for the year.

- Contributing to a retirement fund does more than help you save for and grow your retirement nest egg—if carefully planned, you can reduce your tax liability for years to come.

- Your first day of work at a new job is usually a blur of new names and faces, but at some point you probably filled out a W-4 form.

- Tax liability is the amount of taxes you owe on your taxable income for the year.

The amount of cash required will be affected by changes in the timing of payments to and from the public sector, rather than when these liabilities were incurred. The good news is that the U.S. tax code contains several provisions https://www.bookstime.com/articles/what-is-an-invoice-number that can reduce taxes for high-net-worth individuals. We’ll explain how much high-net-worth individuals, such as millionaires, pay for taxes and discuss strategies they may use to reduce their tax liabilities.

Taxpayers must report all salary, wage, and tip income even if that income is not reported on a W-2. An employer must send out a W-2 form to every employee to whom they paid a salary, wage, or other form of compensation. This does not include contracted or self-employed workers, who file taxes with different forms. The employer must send the employee the W-2 form on or before January 31 each year, so that the employee has time to file income taxes before the deadline, commonly April 15. In a statement issued to Variety, the state EDD indicated that it would make its determination on the use of loan out corporations to process payments and fees paid to individuals on a case-by-case basis.

Liability or Refund?

These forecasts are usually produced twice a year, in spring and autumn. The latest forecast was published in the OBR’s Economic and fiscal outlook – March 2024 report. Public sector net debt is often referred to by commentators as “the national debt”. For further details of our approach, see our Calculation of interest payable on government gilts methodology. We use this information to make the website work as well as possible and improve our services. Contributions to an IRA for people with incomes below certain thresholds.

- They sent this money, your tax withholding, to the IRS on your behalf.

- But it’s much better to pay over time than to ignore your debt and hope it goes away, because it won’t.

- This option involves reaching an agreement with the IRS that it will accept less money than you owe, but the requirements can be stringent and you’ll have to prove your financial circumstances.

- You should work with a financial professional to add this strategy to your financial planning as needed.

- The state disavowed the idea of a “blanket” rule covering tax treatment for all loan out corporations.

- As a result of receiving these data, our estimate of PSND at the end of March 2024 has increased by £13.4 billion to £3.1 trillion.

What Is Capital Gains Tax?

If you’re a teacher, the Teacher Education Deduction lets you claim up to $250 of out-of-pocket costs related to teaching supplies. And Green-Lewis says if you and your partner are both teachers, you both can claim the deduction. what is tax liabilities on w2 If you’re self-employed, or work for an employer and fall into one of these IRS categories, you may be able to can claim the enrollment cost of any required continuing education courses, classes or certifications.

- If you don’t have many deductions to claim, you’ll probably want to claim the standard deduction.

- Every time you receive this paycheck, you have taxes being taken out.

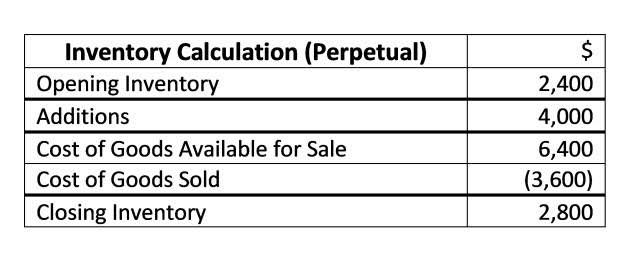

- If in the future you will pay more to the IRS than the tax expense noted in your books, you have a deferred tax liability.

- For example, the calculation for bad debt is different for financial accounting and tax purposes.

Public sector finances, UK: April 2024